Payment Processing Dos and Don’ts

Article Highlights:

- Payment processors are not a commodity.

- A strategy helps you stand out.

There are a lot of payment processing options available to dealerships. However, as electronic purchases have become the standard, comparing processors and choosing a partner is becoming more important than ever. There are differences between each, so what are the most important things to consider?

Factor in wireless Bluetooth terminals. Payments are happening in every department of the dealership, sometimes simultaneously. In service, a Bluetooth-enabled terminal allows a service advisor to accept payments while mobile in the service drive so the customer doesn’t have to wait in line to see a cashier. Quick and easy transactions like this enhance the customer experience.

Keep up with security and PCI compliance. Data breaches can average between $52,000 and $87,000[1], so it’s important to know how information is shared and accessed. Customers don’t want to go through checkout feeling their personal information is at risk, so it’s important to ensure ultimate protection. Point to point encryption and tokenization offer greater security. Maintaining compliance can also be an added burden. If you process credit cards, you are required by federal law to register annually – typically through a questionnaire – as PCI compliant. You could do this on your own, but to lift the weight off your shoulders, only a few providers will work with you through the process.

Don’t accept manual reconciliation processes. Manual keying of RO numbers and amounts can lead to mismatched reporting in the business office at the end of the day. Today’s payment processing is electronic, digital, automated, and nearly instantaneous. Reconciliation shouldn’t be a headache trying to determine where transposition errors occurred.

Offer options. Some older consumers enjoy paying in person with cash or check, while younger generations prefer paying online via text or email. As new payment technologies continue to emerge and become more mainstream, a wide variety of payment options accommodating all lifestyles is key.

Payment processing isn’t as simple as you may think. It’s a world full of dos and don’ts, and sometimes they’re hard to uphold. Bottom line, payment processing should be convenient, efficient, and secure for both your employees and customers.

[1] Verizon

Related Articles:

From Mailbox to Inbox: A Hybrid Approach to Reaching Your Customers

It’s easy to weigh the pros and cons of an email marketing strategy versus a direct mail one. Email marketing delivers your message to customers…

Crafting a Winning Story: Dealership Lessons from Olympic Opening…

While most dealerships aren’t getting Olympic-level coverage, it’s still important to think about what kind of story you’re conveying to consumers.

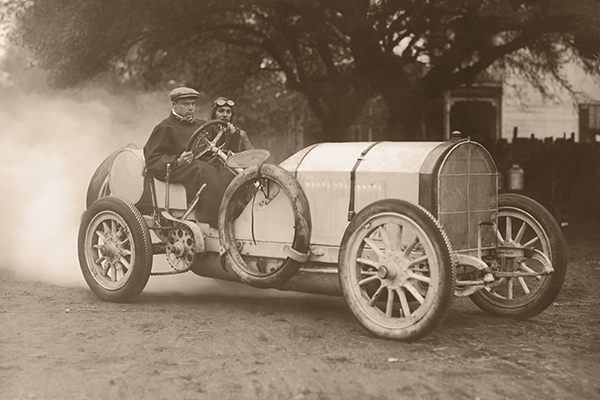

The Evolution of Cars and Consumer Expectations

Have you ever thought about how far the automotive industry has come since the creation of the first car? From three-wheeled cars to punch-inducing Volkswagen Beetles…

4 Things Every Dealership Can Do to Prepare for Future Success

Right now, your dealership is successful and running smoothly. That’s a great first step towards ensuring future success, but there’s always more work to do.…