Don’t Wait Until It’s Too Late: 3 Common Compliance Issues to Address Now

Article Highlights:

- Stay up-to-date in a constantly changing industry.

- Gain clarity on your compliance.

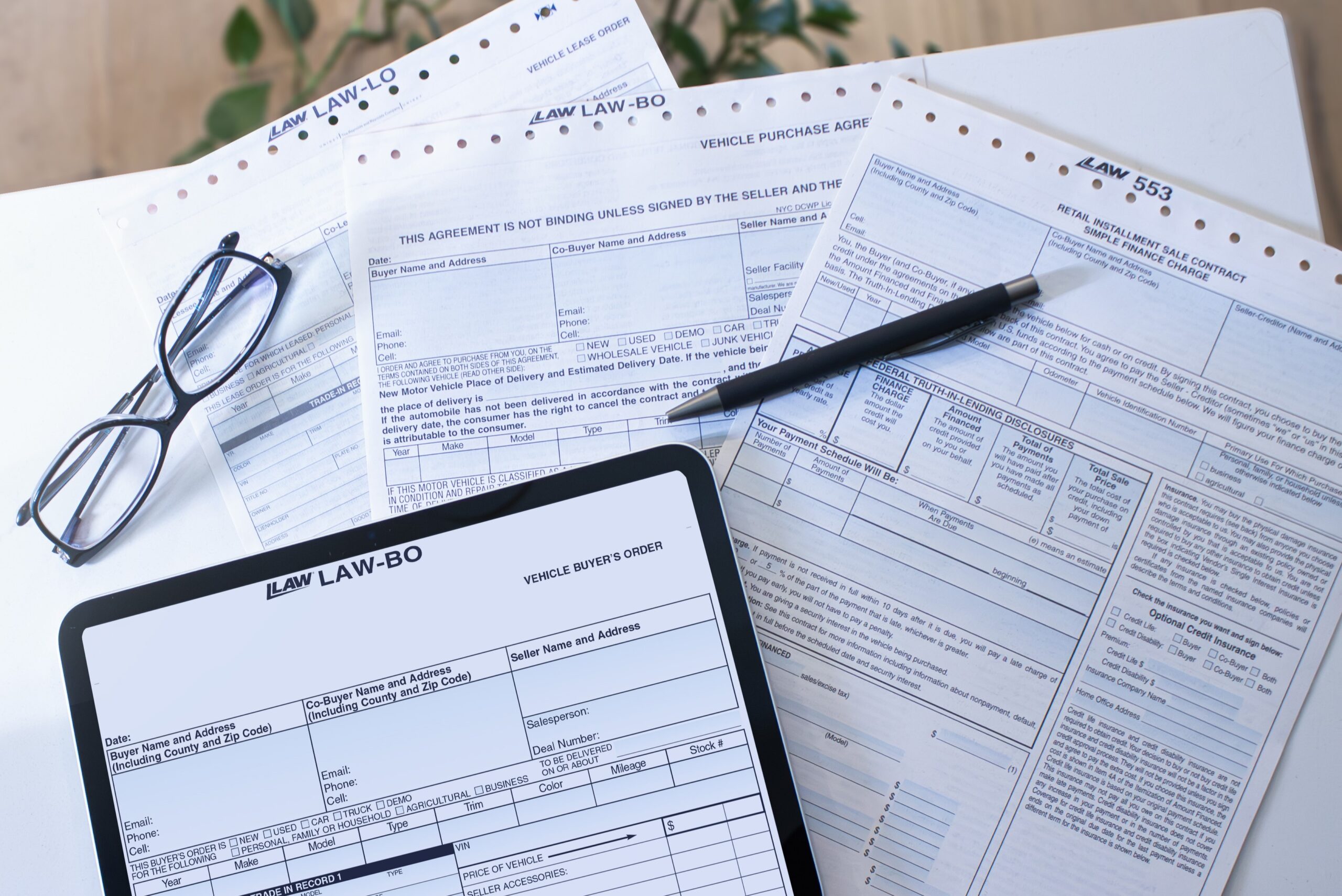

The automotive industry is dynamic and ever-changing, and so is compliance. State and federal regulations, along with best practices, are updated so frequently it can feel challenging to keep your documents up to date.

Regularly reviewing your documents can help reduce some of the risk posed by these frequent changes, but it isn’t always easy to know what to look for. Our compliance consultants have identified a number of common issues with dealership documents through our formal F&I document review process. Below are three of the most common issues found that can potentially create risk for your dealership.

Outdated Documents

Your compliance library probably includes a combination of documents from various sources. Unfortunately, not all libraries automatically review and revise documents for best practice and compliance law changes.

Take your DMV documents for example – DMV forms are updated quite frequently across the country, often covering any fee changes and electronic titling matters. States will often change their documents without any prior notice to the market, so when they publish new forms, you are immediately out of date. It’s hard to know how long DMVs will continue to accept the old form and you run the risk of title applications getting rejected if your documents are outdated.

In addition to your DMV documents, what about any internally created documents – do you keep using them because that’s how it’s always been? It’s important you also have a review process for these documents to know if they are up-to-date with current compliance requirements.

You may also need to contact your DMS provider to be sure they have revised documents and are programmed for use. Not every vendor will update their program in a timely manner, so it’s important to follow up and check they are updating their documents as necessary.

Areas of Risk Not Addressed

Details in your documents matter. It’s important to think about any gaps in your documentation where you may be putting yourself at risk for not addressing those small, but important details. Common risks can be easily avoided by using an agreement or a disclosure with your customer.

When you have a customer test drive a vehicle, do you check they have a license to drive? What about their insurance information – do you obtain proof of coverage? Is there an agreement of who will pay for tolls or driving violations? By having a written Test Drive Agreement with your customer, you can reduce the risk placed on yourself by taking all necessary precautions for protection.

How specific are you with your contact authorization language in your buyer’s orders and retail installment sale contracts? Consumer protection laws focus heavily on contact authorization nowadays, especially on authorization to call the customer and sell more products or services. If you offer a separate form, you can include broader reasons for contact, such as telling the customer of new products and promotions.

These common risk agreements are not required by law, but they can protect you against easily avoidable issues with your customer.

Form Improvement

There are numerous ways forms can be improved to help reduce risk for your dealership. Some of these improvements include missing titles, signature placement, and legalese.

Vehicle sales contracts have a lot of complexities that often result in language the everyday customer doesn’t understand. Having forms written in easy-to-understand language can save your customers a headache and make the sales and F&I process much simpler.

By making these minor form improvements, you can limit room for interpretation and make your customer feel more comfortable during the buying process.

F&I Document Reviews

The common issues above are not an exhaustive list of areas for potential risk. This is why Reynolds Document Services offers a free F&I Document Review. A team of Compliance Consultants will collect all your documents and provide you with an assessment on how to best manage your compliance responsibilities. Don’t wait until it’s too late – contact us today to take a proactive role and start managing your compliance more efficiently.

Related Articles:

The Future of Variable Ops with Experts at NADA 2025

Explore how AI is transforming variable operations in automotive retailing with insights from NADA 2025. Learn about efficiency, profitability, and fraud prevention from industry leaders.

Decision made regarding the Vehicle Shopping Rule – now what?

Check out five key takeaways from the Vehicle Shopping Rule to keep your dealership safe from FTC enforcement actions.

3 Ways AI Can Elevate Your Dealership’s Online Inventory

On average, Americans are exposed to between 4,000 and 10,000 advertisements every day. From commercials on TV to billboards on your way to work, all…

The Pizza Playbook – What Ordering Pizza Teaches Us About F&I

For as long as I can remember, my family had “pizza night” every week. Without fail, every Friday evening we’d all gather around the computer…