4 (+1) Car Buying Trends Setting the Pace

Article Highlights:

- How 2021 trends have carried into 2022.

- The role of F&I as an emergent trend.

I wrote about upcoming car buying trends just shy of one year ago. Since then, those trends are still front and center. In fact, new findings to support them continue to be uncovered, which I’ll get into shortly. What’s more interesting is the emergence of new trends, specifically around F&I. Today, I want to reiterate the importance of last year’s trends that we continue to face, as well as walk through some new ones we are seeing today.

Trend #1: Rise of Couch Shopping (figuratively)

With or without the 2020 pandemic, the industry was already heading in the direction of doing more transactions online. 2020 only put this into overdrive. From credit applications, signing options, and even vehicle pickup and delivery, consumers are wanting more and more pieces of the transaction available remotely.

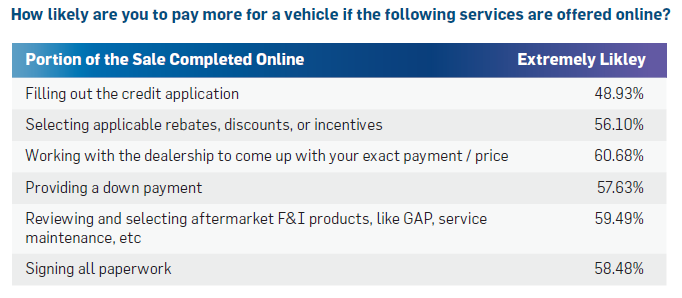

We conducted a study to better understand what specifically they were interested in doing online and if they are willing to pay more. Here’s what we found:

Offering more of these conveniences is the catalyst for more and more purchases. But if more pieces of the transaction continue to be offered and completed online, the challenge becomes having control in the process. What you don’t want to do is completely hand the reigns to the customer and let them shop by themselves. This leads me to something new(er) to consider: the role of F&I in an online world.

[NEW] Trend #2: More Qualified Buyers, More Guidance

Recently, we’ve seen a development in subprime buyers. Every year since 2017, the number of subprime buyers has decreased. Less people truly need help finding financing for a vehicle, and online approvals are getting easier. With this growth in qualified buyers coupled with the increase in remote preferences, the flood gates are opening for more deals.

On top of that, from the same study I mentioned earlier, we found that most consumers (nearly 72%) are not familiar with traditional F&I products – what they are, what they mean, or the value they bring. And 40% say it is extremely important to speak with someone in F&I to help facilitate this piece of the online car buying process. Consumers don’t understand all the inner-workings of aftermarket products, and they need someone on standby to educate them. Otherwise, their default answer is going to be “no”. And despite an uncertain economy, consumers have money to spend. Empower them to say yes more often with the right amount of guidance. You need to have a role in the process and be present for the customer, no matter where they are or how they’re interacting with your dealership.

Trend #3: Frictionless Remains Consistent

Though this somewhat falls under the couch shopping trend, a frictionless experience deserves its own recognition. Historically, consumers have been prone to value convenience. And as we mentioned earlier, they want more and more pieces of the transaction available online. So much that they are willing to pay more.

The tricky part is consistency and accuracy throughout the process. What happens when your customers want to start online but end in-store? What happens when you have a co-buyer located in a different state? Do you find that your F&I managers have to re-enter everything the customer already started online because it didn’t carry over? Or maybe the information just isn’t accurate so they have to spend time reviewing what’s right and what’s wrong.

When a customer wants a blended online to in-store car buying experience or the transaction starts and stops at different points for whatever reason, your dealership needs to be able to pick up exactly where the customer left off. No rekeying of data, no missed signatures. Simply finish the deal, grab the keys, and go. That is the frictionless experience consumers expect.

Trend #4: The Inventory Rollercoaster

Last summer, the chip shortage wrecked the industry. With less new vehicles being produced on the manufacturer level, dealers had no choice but to scrounge for used vehicles in order to keep their lots full.

Additionally, consumers were opting for used over new in general. As prices climbed, used vehicles were more appealing. The quality of vehicles has also improved over the years, so used vehicles don’t carry that negative stigma of being outdated or rundown as much.

The inventory struggle has continued into 2022, so it’s critical you find unique and creative ways to manage inventory – from both sourcing and reconditioning. We sat down with Clint McLaren of Wiesner of Huntsville to understand what his dealership is doing to stay ahead. You can read and watch the full interview here.

And let’s not forget about the direct to consumer threat from OEMs when it comes to EVs, which are also on the rise with consumers. With less opportunities to sell, maximizing profitability and efficiency during every customer interaction will be the make or break moving forward.

Trend #5: Loyalty No Longer a Bargaining Chip

Customer loyalty used to be fairly strong. Shoppers would stick with a certain brand and even sometimes a specific dealership. Today, that ship has sailed. In a recent study, over half of the brands analyzed had a less than 50% brand retention rate. This means consumers are no longer shopping based on brand or dealership. They’re shopping based on price. They simply want the best, well-rounded deal, even if that means sacrificing a little bit of the experience.

Remember, buyers want more pieces of the transaction to take place online. To capture these price conscious buyers in the midst of their online experience, it’s what you display and offer that matters. Allow them to play with payment calculators and review finance versus lease, add incentives and protection products, apply a trade-in, and start the qualification process. The more price info you can provide upfront, regardless if the customer is in your showroom, the more you are able to capture their attention.

Your Next Move

Trends definitely come and go, but I believe what we’ve seen in recent years are more than just trends. It’s the new way of life and doing business. The dealerships that fail to address the changing car buying landscape will eventually fall to the wayside. So think about these trends, adoptions, and how they will continue to shape our industry moving forward.

Related Articles:

The Future of Variable Ops with Experts at NADA 2025

Explore how AI is transforming variable operations in automotive retailing with insights from NADA 2025. Learn about efficiency, profitability, and fraud prevention from industry leaders.

Decision made regarding the Vehicle Shopping Rule – now what?

Check out five key takeaways from the Vehicle Shopping Rule to keep your dealership safe from FTC enforcement actions.

3 Ways AI Can Elevate Your Dealership’s Online Inventory

On average, Americans are exposed to between 4,000 and 10,000 advertisements every day. From commercials on TV to billboards on your way to work, all…

The Pizza Playbook – What Ordering Pizza Teaches Us About F&I

For as long as I can remember, my family had “pizza night” every week. Without fail, every Friday evening we’d all gather around the computer…