Replacing a Transaction With an Experience

Article Highlights:

- The buying process relies heavily on the payment process.

- Three ways to transform your customer’s payment experience.

Consumers demand more from a purchase than ever before. A purchase is no longer just a transaction, it’s an experience. It starts when they Google your dealership. When does it end? Some say it ends when the customer drives off in their new car. But does it?

If each interaction provides a good experience, your customer will be back. It could be for regular service visits, an accessory upgrade, or even when it’s time for a new car altogether. The opportunity to provide great buying experiences is endless.

How your customers will remember their experience is largely driven by the last impression of each interaction – the payment process. It’s a huge deciding factor in whether customers recommend your dealership.

Making the payment process an experience your customers enjoy includes four key elements: simplicity, options, convenience, and security.

Do more than what is expected.

With a simple payment experience, paying the bill is no longer viewed as a negative piece of the process. It’s possible to:

- Accept down payments in F&I and never leave the customer alone or take their credit card out of sight.

- Offer Bluetooth-enabled tablets in service so service advisors can accept payments wherever the customer is – no need for the customer to get in line to see a cashier.

- Securely store credit card information for parts wholesale customers to expedite the payment process.

- Allow companies to pay online, with a stored card, for work done on their fleet vehicles.

- Email A/R statements to customers with direct links in the invoice so they can pay online.

Offer options.

With so many ways to pay, you need to offer payment options to please everyone. Often times older consumers still enjoy paying in person with cash or check. Younger generations prefer paying online, via text or email.

New payment technologies continue to emerge and will become more mainstream as time goes on. These include mobile wallets, such as Apple Pay or Samsung Pay, and tap-to-pay technologies. Is your dealership offering these different payment options to your customers?

Convenience holds power.

One of the benefits of offering newer payment technologies like online payments or tap-to-pay is convenience. Time is a limited resource, no one wants to waste it. To provide extra convenience to customers:

- Install a fast-lane checkout in your service department for customers who have paid online.

- Allow customers to put down a vehicle deposit online, without having to come to the store or call the dealership.

These provide perceived value to your customer and create efficiencies in your store.

Keep customer information under lock and key.

Whether consumers pay online or in-person, security is still a focus. You should be offering payment through EMV-compliant terminals. Other important card protection factors include point-to-point encryption, tokenization, and PCI-compliance. When storing payment information, your system must be able to protect the data, even though there isn’t a physical card present. In 2018, it was reported by Business Insider that Marriott hotels had a data breach that included payment card numbers and expiration dates of 500 million people. For your customers to keep doing business with you, they must trust you will protect their information.

A great experience with every transaction.

Bottom line, the last step of each transaction shapes how your customers remember their experience. To keep them coming back, focus on simplicity, options, convenience, and security in your payment process. Check out this whitepaper to learn how to empower your employees with the right payment processing technologies that will create an experience customers enjoy.

Related Articles:

From Mailbox to Inbox: A Hybrid Approach to Reaching Your Customers

It’s easy to weigh the pros and cons of an email marketing strategy versus a direct mail one. Email marketing delivers your message to customers…

Crafting a Winning Story: Dealership Lessons from Olympic Opening…

While most dealerships aren’t getting Olympic-level coverage, it’s still important to think about what kind of story you’re conveying to consumers.

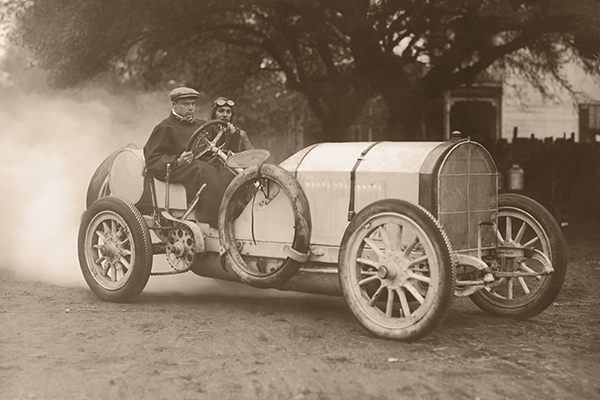

The Evolution of Cars and Consumer Expectations

Have you ever thought about how far the automotive industry has come since the creation of the first car? From three-wheeled cars to punch-inducing Volkswagen Beetles…

4 Things Every Dealership Can Do to Prepare for Future Success

Right now, your dealership is successful and running smoothly. That’s a great first step towards ensuring future success, but there’s always more work to do.…