5 Ways Employee Theft Happens

Article Highlights:

- Most dealership theft occurs from employees without a criminal background.

- Learn 5 tips to help prevent or uncover suspicious activity.

It’s hard to imagine someone in your dealership stealing from you, but for many dealers that’s reality. We all believe we can trust our employees and don’t like to think of them as criminals, however, according to Randy Domigan, CPA, 62% of dealership theft comes from employees and most dealership theft occurs from employees who have no prior offenses. With all this uncertainty, what are you doing to protect your dealership?

Here are five ways employee theft could happen at your dealership:

- Employees never take vacation. Even the most dedicated employee needs a break. If not, they become the single point of failure for their job role and they get burnt out. Additionally, theft is often uncovered by chance when the guilty employee is out of the office and someone is handling their responsibilities.

- You don’t approve all checks. It is important to review and audit Accounts Payable processes and how receipts are posted. If you aren’t keeping track of electronic payments and you don’t know who is in charge of these regular checks, then how can you be sure there isn’t theft occurring?

- You don’t have a tip hotline. In some cases others may see what’s going on, but are afraid they’d lose their job or cause distress in the workplace. They might not want to show up in your office and confess what they know. Providing a hotline or a drop box to report concerns will allow them to speak up and remain anonymous.

- There aren’t clear guidelines at your dealership. If you don’t set expectations, goals, and objectives, your staff may feel like you aren’t fully invested in the dealership or that you aren’t paying attention.

- You don’t have a monitoring plan. Creating guidelines and approving checks can take you far, but investing in software that can monitor your system’s day-to-day activities can go a long way in uncovering and reducing the risk of losses. Even if you have a CPA, most do not look for fraud. Even if they did, do they know your system and process well enough to find it?

You can’t be everywhere at once and hiring the ‘right’ people isn’t enough either. You need a way to check for questionable activity quicker and easier than pulling endless reports and asking a bunch of questions. Consider putting in safeguards for the issues above and use a system to monitor historical data across your dealership so you can easily see potentially harmful activity as it’s happening and take action.

Related Articles:

From Mailbox to Inbox: A Hybrid Approach to Reaching Your Customers

It’s easy to weigh the pros and cons of an email marketing strategy versus a direct mail one. Email marketing delivers your message to customers…

Crafting a Winning Story: Dealership Lessons from Olympic Opening…

While most dealerships aren’t getting Olympic-level coverage, it’s still important to think about what kind of story you’re conveying to consumers.

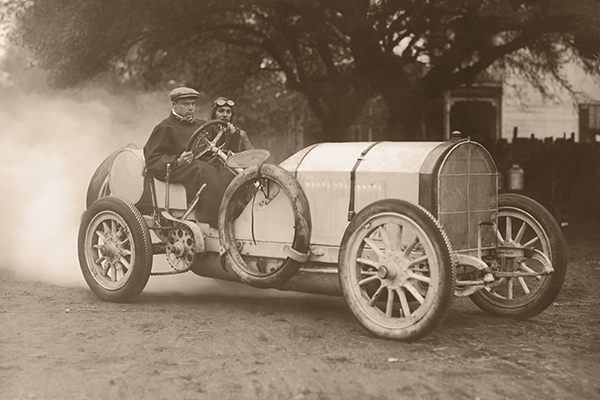

The Evolution of Cars and Consumer Expectations

Have you ever thought about how far the automotive industry has come since the creation of the first car? From three-wheeled cars to punch-inducing Volkswagen Beetles…

4 Things Every Dealership Can Do to Prepare for Future Success

Right now, your dealership is successful and running smoothly. That’s a great first step towards ensuring future success, but there’s always more work to do.…