What Hasn’t Changed for Car Dealers in 2017—and Why It’s Still Hurting Business

Article Highlights:

- Self-imposed taxes are hurting profits, retention, and profitability.

- You need to pair the right technologies with the right processes.

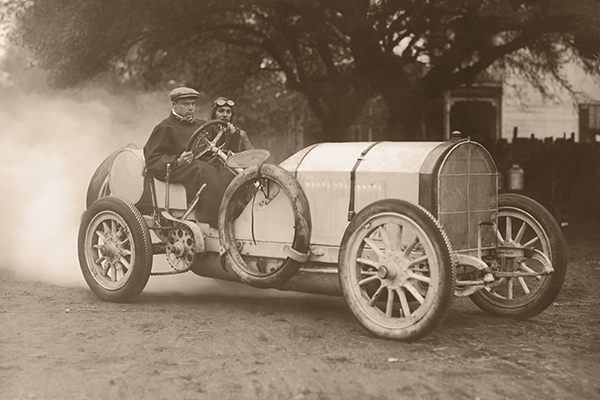

It was 1917 when the National Automobile Dealers Association was founded to fight a five percent luxury tax on automobiles proposed by Congress.

How ironic, then, that 100 years later, dealers are taxing themselves and hurting dealership sales, customer retention, and profitability.

In the midst of automobile sales that have improved steadily year after year since the recession, NADA data indicates dealerships continue to face lower or stagnant profit margins, increased compliance requirements, and higher operating costs. In addition, results in 2016 compared to 2015 showed on average that dealership front-end gross decreased, days-to-turn increased, and return-on-investment fell. At the same time, consumer mistrust in the dealership process and experience remained high.

Throughout all of these trends, dealership employment has steadily increased and is now above pre-recession levels at more than 1.1 million. Yet, with average employee turnover in dealerships now at nearly 40 percent, dealers have unwittingly added an ongoing tax to operations—an employee “turnover tax.”

In addition to the employee turnover tax, other self-imposed taxes include:

- Diminished service loyalty. More than two-thirds of consumers who purchase a vehicle from a dealership choose not to return to the dealership for service. That untapped revenue potential serves as a self-imposed tax that lowers operating profit.

- No additional service recommended. Seven out of 10 customers who do service their vehicles at a dealership are not presented with recommendations for additional service by the service advisor. That untapped potential revenue also serves as a self-imposed tax that lowers operating profit.

- Inadequate reporting insights. When reporting tools fail to provide insights and “what if” scenarios that uncover operating weaknesses or leverage operating strengths, the result is an ongoing drain on profitability—another hidden tax.

- Drowning in paper. F&I paperwork takes nearly three dozen forms to complete. Deal jackets can be more than an inch thick. Compliance requirements are increasingly stringent. Dealership personnel in different departments are stymied in taking the next step in a vehicle transaction as they wait for paper to make its way to their desks. At the same time, dealers are expending untold amounts of staff time and effort—and money—to physically file, archive, retrieve, and, ultimately, purge paper documents. A constant tax on operations.

In all of these examples, whether expenses are added or potential revenue is missed, it all hits the bottom line, draining profitability as surely as if it were a tax on earnings.

How best to eliminate these self-imposed taxes and close the profit gaps?

Recent McKinsey and NADA studies point to a number of factors, but one clearly stands out as the biggest component of potential profit for dealerships: Adopting operating best practices.

And one of the surest ways to implement best practices is to pair the right technologies with the right processes for dealership employees.

Reynolds has both.

While we don’t pretend to have every answer when it comes to technology and operating improvements, we are confident we have the right answers.

For the past 10 years, Reynolds has been investing steadily in developing the products and services that will help dealers meet these challenges head on.

The result: Our customers gain a significant competitive advantage measured by new dollars earned, compliance standards met, operating benchmarks surpassed, and a changed consumer experience with the dealership.

Stop by the Reynolds booth at NADA and see what our technologies and processes can mean for your business—your customers, your employees, and your results—minus the self-imposed taxes.

Related Articles:

From Mailbox to Inbox: A Hybrid Approach to Reaching Your Customers

It’s easy to weigh the pros and cons of an email marketing strategy versus a direct mail one. Email marketing delivers your message to customers…

Crafting a Winning Story: Dealership Lessons from Olympic Opening…

While most dealerships aren’t getting Olympic-level coverage, it’s still important to think about what kind of story you’re conveying to consumers.

The Evolution of Cars and Consumer Expectations

Have you ever thought about how far the automotive industry has come since the creation of the first car? From three-wheeled cars to punch-inducing Volkswagen Beetles…

4 Things Every Dealership Can Do to Prepare for Future Success

Right now, your dealership is successful and running smoothly. That’s a great first step towards ensuring future success, but there’s always more work to do.…