Subtract Bad Processes for Positive Cash Flow

Article Highlights:

- Cash flow is one of the most important pieces keeping your business afloat.

- There are certain business office practices putting it at risk.

If numbers, data, and equations excite you, you might work in the business office. Day in and day out, you live in a world of positives and negatives through financial statements, reporting trends, and assets and liabilities, just to name a few.

But the most critical positive and negative you encounter? Cash flow.

You know the power of cash flow; it can make or break business stability. If profitability were food, cash flow would be water. Because although profits are important, cash flow is absolutely critical when inventory is scarce and demand is high.

Now more than ever, cash flow is the lifeline of the dealership, making it your top priority to maintain its health. So what can you do to have a positive impact on your dealership’s cash flow? Let’s break it down into an equation:

Negative cash flow is the sum of three major problems – Inefficient processes, inconsistent flow of cash, and ineffective payment options.

Let’s look at what you need to add and subtract from your business office to ensure positive cash flow.

Subtract: Mailing AR Statements and AP Invoices

If we look at our negative cash flow equation, this hits all three. Spending hours of time printing documents and stuffing and mailing envelopes makes this process inefficient. Then, you’re left to wait for your checks to clear or payments to be mailed back, leaving cash flow on an unpredictable timeline.

Ultimately, this stems from having ineffective payment options for both your dealership and your customers. These antiquated processes are keeping your dealership from optimizing cash flow, but it doesn’t have to be that way.

Add: Digitized and Streamlined Payment Options

Don’t let payment options, or lack thereof, hold your money hostage. Give customers and vendors digital payment options on invoices to make the transaction quick, easy, and painless. When you email an invoice with a link to pay online, you remove the customer’s headache of mailing you a check, and you get your money faster.

Then, when it comes time to pay your vendors, you have a payment processing tool that handles your payments without you ever having to leave your system. Plus, by adding digital and streamlined payment options, you can cut out the chore of printing, stuffing, and mailing those statements.

Who would’ve thought a less hands-on process would actually mean more control?

Subtract: Sending AP Payments Once or Twice a Month

Sending out all AP payments once or twice a month isn’t helping you or your vendors. It takes a ton of time and doesn’t always get to the vendor when their payment is due. Plus, it’s taking a huge hit to your cash flow.

If your vendors decide to cash in at once, your cash flow is at risk by having a large sum come out when half your payments weren’t due for another two weeks. If vendors wait to clear your check, money is floating around and your cash flow isn’t accurate. Will it be 3 days or 3 weeks?

Taking control of your cash flow is imperative for its health.

Add: Paying Vendors on Time Throughout the Month

Giving your vendors better payment options can help cash flow, but that’s half the battle. By eliminating a once-a-month payment run, you put the control of cash flow in your own hands.

Cash flow is just as much about keeping it accurate as it is keeping it positive. Paying your vendors on time throughout the month means payments are made optimally on payment due dates, and you have better visibility over the changes coming your way. You are able to plan for money leaving your dealership, have a better and more accurate understanding of financial health, and key stakeholders are better equipped to make business decisions.

Let’s “Sum”marize

In your dealership, cash (flow) is king, meaning your business office must do everything in its power to optimize it. To make sure your business is set up for financial success, you need to subtract bad processes like mailing statements and making AP payments once or twice a month. When you do, you can add in processes like digitized and streamlined payment options and optimized vendor payments throughout the month.

So, if you can give your dealership the best possible chance for positive cash flow, why wouldn’t you?

Related Articles:

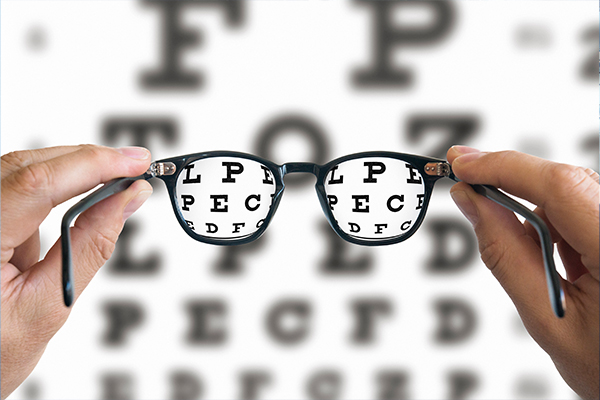

Seeing Clearly: Reporting That Shows You the Full Picture

Reporting is essential to a profitable business, but you might be seeing a partial picture. Standing between you and the full picture: your reporting tool.

Quarterbacking Your Deals: The Strategic Advantage of eContracting

As the college football season approaches, dealerships can gain valuable insights from the strategic capabilities of college football teams. Just as quarterbacks must think on…

Beware and Prepare: What You Can Learn from the “Ides of…

For Julius Caesar, listening to a warning was a matter of life or death. When it comes to keeping your business healthy and profitable, staying…

Sleighing the Reporting Game: Digitizing Your Business Office

The enchantment of the holiday season is undeniable. As the living room fireplace crackles with life, its warmth greets you with a cozy embrace. Fresh…