Profit Isn’t Just About Revenue: Fixing Your Accounting Department

Article Highlights:

- Inefficiency, error, fraud, and embezzlement lead to profit drain.

- Increase efficiency and force accountability to create a new profit center.

When automotive retailers think of creating new profit centers in the dealership, the accounting department is usually not the first place to come to mind.

That’s understandable since the bulk of the work done here doesn’t typically directly generate revenue. No one is selling a car or service in your accounting department.

But, is increasing revenue the only way to increase profitability? Of course not. In fact, it’s not always even the best way. An equally effective approach is cutting costs and streamlining workflows to boost productivity and effectiveness.

And as it turns out, there’s a lot of preventable profit drain going on in the typical dealership accounting department, from fraud and embezzlement to simple human errors that lead to recontracting or other time-consuming corrections.

In other words, the greatest threat to your profitability in the accounting department stems from money going out the door under the radar, either from inefficiency or lack of accountability. Accordingly, the way to fix this and turn your accounting department into an unexpected profit center is to invest in solutions that introduce process efficiency and force accountability.

Let’s take a closer look at some of the most common issues plaguing dealership accounting departments and discuss what steps you can take today to create a new profit center in your dealership.

Fraud and Embezzlement

Fraud and embezzlement are not the most common causes of profit loss in accounting, but they can be the most difficult to confront and, in cases where they go undetected for long periods of time, the most financially damaging.

Consider the case of a comptroller at a BMW dealership in Connecticut who managed to embezzle more than $1.1 million between October 2014 and June 2017. During that time frame, she issued nearly 30 fake checks and nearly 70 unauthorized EFTs while accruing more than $30,000 in personal credit charges and reimbursements.

Do you review closed ROs only to find the amounts don’t match the receipts? Are you consistently not realizing the profit margins you feel you should be in sales or F&I? If a pattern becomes detectable, it’s critical to take the possibility of employee theft seriously (without jumping to conclusions before you’ve done your due diligence, of course).

How do you handle potential theft? You could bring in an outside party of forensic accountants to conduct a surprise audit. This is undeniably effective, but it also isn’t cheap. Another option would be to reevaluate your current practices and improve your processes from within to force accountability.

That means adhering to strict, standardized controls over the dealership’s finances, with no exceptions for any employee. It also means considering investing in a solution that automates daily reports to show which transactions are still open, which payments are still due, and what transactions look suspicious.

Such a solution would empower you to drill down into individual transactions to pinpoint where the issues are, cutting out manual research and helping you find missing money faster.

Inefficiencies and Missed Opportunities

What’s far more common than outright theft, however, are unnecessary expenses and missed revenue opportunities across the payment, contracting, and accounting processes that can end up costing your dealership significantly.

The cost of paper itself is staggering. Paper alone costs offices $80 per employee annually. How many employees do you have? Is this a cost you want to overlook? Not to mention the $220 on average it takes to replace lost documents. And then add on toner, storage space, and postage, and the numbers get big, fast.

Or, perhaps you are missing out on opportunities to generate revenue in the accounting department. By using a solution that does the work for you, you can pay vendors quickly through single-use virtual card payments and collect cash rewards from those electronic transactions.

Fortunately, as common as these issues are in dealership accounting, all of them are both fixable and preventable. It is possible to staunch the flow of money going out the door, but it starts with you deciding to make accountability, accuracy, and efficiency some of your business’s top priorities going forward.

That means scrapping the old manual processes that haven’t changed in 20 years in favor of digitizing the contracting process, synchronizing and smoothing out workflows across the business, and simplifying payments for both your customers and your vendor partners to make reconciling transactions at the end of the day a breeze.

Conclusion

Increasing profitability isn’t just about generating extra revenue – it’s about running a better business. Start taking steps to address longstanding issues in your accounting department today, and you may just end up with an unexpected new profit center to show for it.

Related Articles:

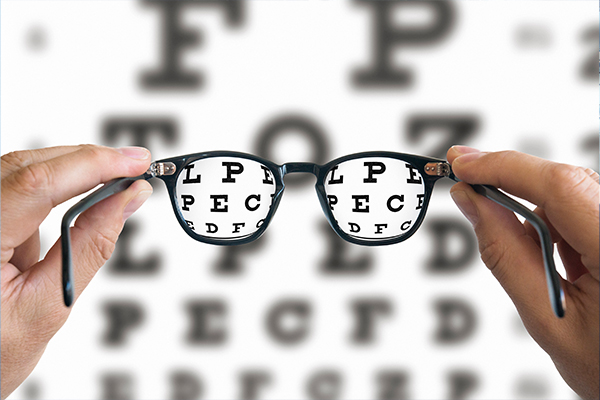

Seeing Clearly: Reporting That Shows You the Full Picture

Reporting is essential to a profitable business, but you might be seeing a partial picture. Standing between you and the full picture: your reporting tool.

Quarterbacking Your Deals: The Strategic Advantage of eContracting

As the college football season approaches, dealerships can gain valuable insights from the strategic capabilities of college football teams. Just as quarterbacks must think on…

Beware and Prepare: What You Can Learn from the “Ides of…

For Julius Caesar, listening to a warning was a matter of life or death. When it comes to keeping your business healthy and profitable, staying…

Sleighing the Reporting Game: Digitizing Your Business Office

The enchantment of the holiday season is undeniable. As the living room fireplace crackles with life, its warmth greets you with a cozy embrace. Fresh…