Errors Are Coming: The Problems with Manual Data Entry

Article Highlights:

- Manual data entry could end up costing you.

- F&I and Accounting can work from the same information.

Maybe you never considered how Game of Thrones could relate to your dealership. After all, there probably isn’t a throne, no one owns a fire-breathing dragon, and everyone has a pulse. But if you’re making manual adjustments to every deal so it can be posted in accounting, there’s a chance your business office is living in the time of Westeros.

Determining where and when adjustments are needed can be very time-consuming and tedious. Employees can get distracted, take shortcuts, or work overtime to get the changes made. This approach can result in mistakes and lead to flawed business decisions based on incorrect data. This is the basis of the entire series of Game of Thrones. It’s action based on misinformation.

A prime example of manual adjustments in accounting is the posting and tracking of aftermarket accessories. Accessory sales represent $44.7 billion in sales annually and more and more dealerships are starting to focus on how to get a piece of those profits. Tracking these sales today requires more effort than the past. Each aftermarket product may have a unique sale and COS account. The items might be controlled by different data elements. For many dealerships, this means adding lines to the deal and posting the sale manually. With each manual addition, is another opportunity for mistakes.

Additionally, by manually entering aftermarket products into different accounts, your dealership runs the risk of overpaying or underpaying F&I for the products sold.

How can you reduce the likelihood of human errors and a War of Five Kings?

- Use a system that allows for smoother communication between F&I and accounting. Your DMS is one piece of software with many parts that should function together. Think of an army; if one division doesn’t follow the plan or doesn’t know what to do, you aren’t going to reach the Iron Throne. It’s the same for F&I and accounting. To be the most efficient you can be, everyone should be on the same page.

- Eliminate the need to manually calculate amounts. If F&I thinks they’re getting paid one amount, and accounting thinks it’s another, you don’t need a three-eyed raven to tell you there is going to be time wasted discussing who is right instead of time spent focusing on sales and customers.

- Fix mistakes you find in accounting and F&I, not just one or the other. Only having half of the information doesn’t make your dealership efficient. Consider this: if Westeros had a system where information was accurate and up-to-date throughout, Jon would’ve known he was the rightful king all along and peace would’ve been restored four seasons ago.

By reducing reliance on manual data entry, your dealership will experience less errors, better communication between departments, and more efficiency. Maybe you’ll even win the game of thrones.

Related Articles:

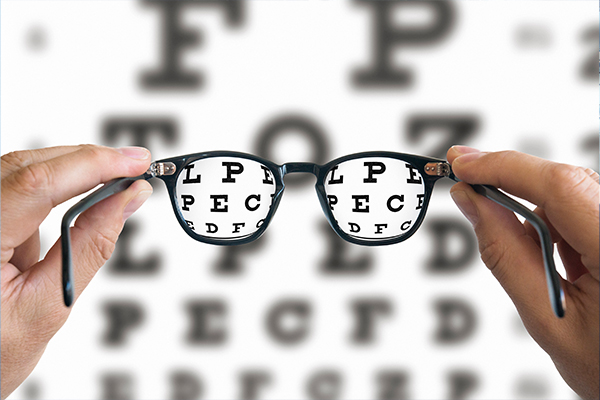

Seeing Clearly: Reporting That Shows You the Full Picture

Reporting is essential to a profitable business, but you might be seeing a partial picture. Standing between you and the full picture: your reporting tool.

Quarterbacking Your Deals: The Strategic Advantage of eContracting

As the college football season approaches, dealerships can gain valuable insights from the strategic capabilities of college football teams. Just as quarterbacks must think on…

Beware and Prepare: What You Can Learn from the “Ides of…

For Julius Caesar, listening to a warning was a matter of life or death. When it comes to keeping your business healthy and profitable, staying…

The Future of Variable Ops with Experts at NADA 2025

Explore how AI is transforming variable operations in automotive retailing with insights from NADA 2025. Learn about efficiency, profitability, and fraud prevention from industry leaders.