Are You Treading Water or Pulling Ahead?

Article Highlights:

- Gross profit as a percent of sales has declined for the past five years.

- Investing in the right technology has never been more important.

Consider this hypothetical scenario: You have an opportunity to invest in one of two new retail businesses. Both share similarities and also appear to have marked differences.

Here are the businesses.

Business #1

Acme Consumer Goods sells well-established, brand-name products that are familiar sights at retail outlets across the U.S.

Acme’s industry survived the recession in relatively good shape, after working through supply chain problems. At the same time, more than 20 percent of the retail outlets in Acme’s industry closed, both stand-alone stores and those in malls. As a result, this business today competes for customers against far fewer Acme retail outlets than six years ago.

Over the past few years, revenues and unit sales across Acme’s industry have increased at an annual rate of more than 7 to 10 percent. While analysts recognize that pace of sales increase likely can’t be sustained, nonetheless, the momentum appears strong for these businesses.

Business #2

The other business is Barclay Consumer Goods. It’s an equally well-established set of brands across the U.S. Like many businesses in the recession, some stores closed but those who survived now face less direct competition from other Barclay stores.

Sales in this industry have had a good run after a low point in the recession, but have stalled of late. More telling, for the average Barclay store over the past several months, gross profit and net profit as a percent of sales have been declining, even as sales overall have been increasing.

Still, Barclay’s sells a product that consumers will continue to buy and need for years. Plus, the maintenance departments at Barclay stores – typically money makers – left a lot of revenue on the table over the past several years. So there’s opportunity in that area, too.

Your Decision

The business broker has a tight deadline. You need to decide now. Which business should you invest in?

Don’t panic. Whichever one you choose, you can’t go wrong. That’s because they’re actually the same business. Both scenarios describe automotive retailing circa 2008 through 2016, but from very different perspectives.

A snapshot of NADA data shows industry sales have steadily risen since the recession.

- Yet, for the past three years as sales have risen, average dealership net profit as a percent of sales has been stagnant.

- Gross profit as a percent of sales has declined for the past five years.

- And dealerships now employ more people than before the recession – when the same numbers of vehicles were being sold.

Faced now with the prospect of a sales plateau – four of the past six months have been down, year over year – dealers are taking a more serious look at how to add new profit centers in their dealership and how to identify new ways to improve operating performance and lift profit numbers.

On first glance, most dealerships may see only limited options. Cutting costs is unlikely to be a long-term solution. After the recession, most dealerships already tightened their expense control. Nor are they likely to add non-automotive businesses at the dealership to increase sales.

So, where do you turn?

First, you’d want to look at traditional profit centers in the dealership – can they be reinvented to capture more revenue in each transaction? There’s no reason dealers should miss out on more than $300 per vehicle in revenue because of inefficient processes or the wrong technologies. Is that your dealership?

Next, you’d want to look at new profit centers that can be added to the dealership and tied closely to the dealer’s core business of automotive retailing. There’s no reason dealers should hand over nearly $400 per vehicle to after-market stores, while also missing a critical step in cementing a lasting customer relationship. Is that your dealership?

Third, you’d want to take a broader view of the consumer’s entire journey through buying and servicing a vehicle.

It’s not uncommon for retailers in other industries to leave 2-3 percentage points in revenue on the table by not focusing adequately on the customer experience and the entire customer journey. Could that hold true in your dealership?

In all of these examples, investing in the right technologies should initiate operating changes that improve efficiency and effectiveness. Those technology investments also should help change the dynamic between the dealership and the consumer. That new dynamic should create a more rewarding consumer experience in the dealership and, at the same time, optimize customer satisfaction – and store revenues.

Investing more in the right technologies may not be top-of-mind to most dealers as the pace of industry sales slows. For most dealers, what they’re doing right now is just fine.

But, underneath the surface, dealers have to ask: Are they treading water or pulling ahead to lap the competition?

Winning dealers are pulling ahead.

Here is one example.

Related Articles:

From Mailbox to Inbox: A Hybrid Approach to Reaching Your Customers

It’s easy to weigh the pros and cons of an email marketing strategy versus a direct mail one. Email marketing delivers your message to customers…

Crafting a Winning Story: Dealership Lessons from Olympic Opening…

While most dealerships aren’t getting Olympic-level coverage, it’s still important to think about what kind of story you’re conveying to consumers.

The Evolution of Cars and Consumer Expectations

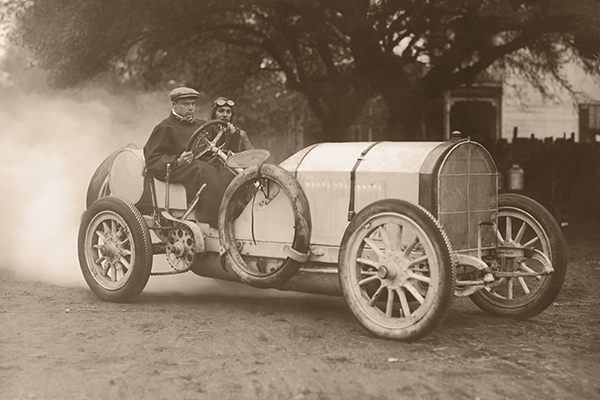

Have you ever thought about how far the automotive industry has come since the creation of the first car? From three-wheeled cars to punch-inducing Volkswagen Beetles…

4 Things Every Dealership Can Do to Prepare for Future Success

Right now, your dealership is successful and running smoothly. That’s a great first step towards ensuring future success, but there’s always more work to do.…