“Can I Pay With Apple Pay?” 3 Reasons You Should Say Yes

Article Highlights:

- Over half of Millennials use smartphones to make mobile payments.

- NFC payments can reduce time at the point-of-sale terminal by up to 77%.

Over half of Millennials use smartphones to make mobile payments, and that number is expected to continue to increase. Pair that with consumers’ wide adoption of Web-enabled phones, and companies will be expected to finds ways to add to the everyday value and utility of smartphones.

One advancement becoming more popular is Near Field Communication (NFC), a technology that allows one device to communicate wirelessly with another. This technology has been around for years but recently has been adopted as a way to facilitate cashless payments.

Most new cell phones have the capabilities to make NFC payments through applications such as Apple Pay or Google Wallet. And, consumers who use those apps expect retailers, including dealerships, to accept their preferred method of payment.

Here are three benefits of adopting NFC payment technology in your dealership:

- Fewer payment roadblocks – To use an NFC payment option is as simple as waving a phone and tapping a screen. This means less time spent waiting at the payment terminal, fumbling for the right credit card, searching for the exact change, or signing receipts on screen or on paper. In addition to improving the customer experience, certain services that support NFC payments help ease data reconciliation in the dealership by sorting, searching, and comparing detailed credit card transaction reports.

- Better customer experience – The more time it takes to complete a simple payment transaction, the more frustrated customers get. Cut down on wasted time in the dealership and pump up the customer experience by using newer, faster payment options. Customers also can pre-load coupons or retailer discounts without adding any extra steps to the checkout time. Without excess paper changing hands, NFC payments can reduce time spent at the point-of-sale terminal by up to 77 percent (pymnts.com).

- Increased security – With NFC payments, consumer credit information is transformed to a unique identification security code and sent to the merchant instead of the credit information, so it doesn’t enter the point-of-sale terminal. This lessens the chances of the consumer being victim in the event of a data breach and helps protect the retailer from liability issues.

Conclusion

Near Field Communication is already here, so don’t wait to contact your payment solutions provider to confirm your payment terminal is NFC-compliant. If you’ve already upgraded for the coming EMV liability shift later this year, you should have NFC payment abilities. If not, consider adding NFC when you upgrade your terminals.

Related Articles:

From Mailbox to Inbox: A Hybrid Approach to Reaching Your Customers

It’s easy to weigh the pros and cons of an email marketing strategy versus a direct mail one. Email marketing delivers your message to customers…

Crafting a Winning Story: Dealership Lessons from Olympic Opening…

While most dealerships aren’t getting Olympic-level coverage, it’s still important to think about what kind of story you’re conveying to consumers.

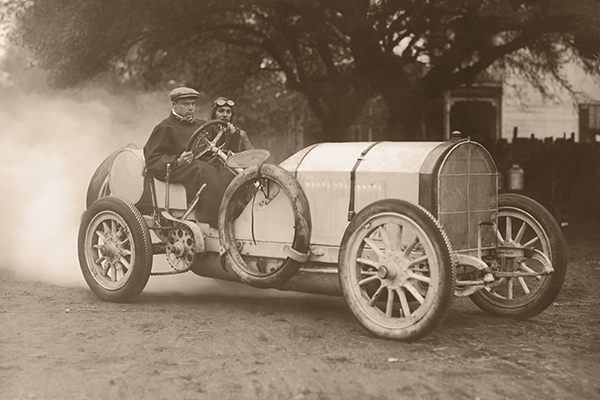

The Evolution of Cars and Consumer Expectations

Have you ever thought about how far the automotive industry has come since the creation of the first car? From three-wheeled cars to punch-inducing Volkswagen Beetles…

4 Things Every Dealership Can Do to Prepare for Future Success

Right now, your dealership is successful and running smoothly. That’s a great first step towards ensuring future success, but there’s always more work to do.…